Processes Payments & Reimbursements for:

- University of Maryland College Park

- University of Maryland Center for Environmental Science

- University System of Maryland

- University of Maryland Shady Grove

Vendors are encouraged to register for ACH payments on the state's website

- The process takes approximately 3 to 4 weeks for vendors to be activated.

- Vendors must be on the university's vendor file before they can register for ACH, otherwise the vendor will receive a check payment.

Once payments are approved by the University and disbursed by the state, the University's obligation is fulfilled, and all goods/services should be rendered to the University by the vendor/supplier.

- Any disputes or questions related to liability offsets (state or federal) should be taken up with the state of Maryland using the contact information below:

- State Information, tax debt withholding, or state liability offset notices (Phone: 410-767-1642)

- Federal Information and Federal Offset of Payments (Phone: 410-260-7350)

The University does not pay sales taxes if the vendor has a physical location in MD or DC.

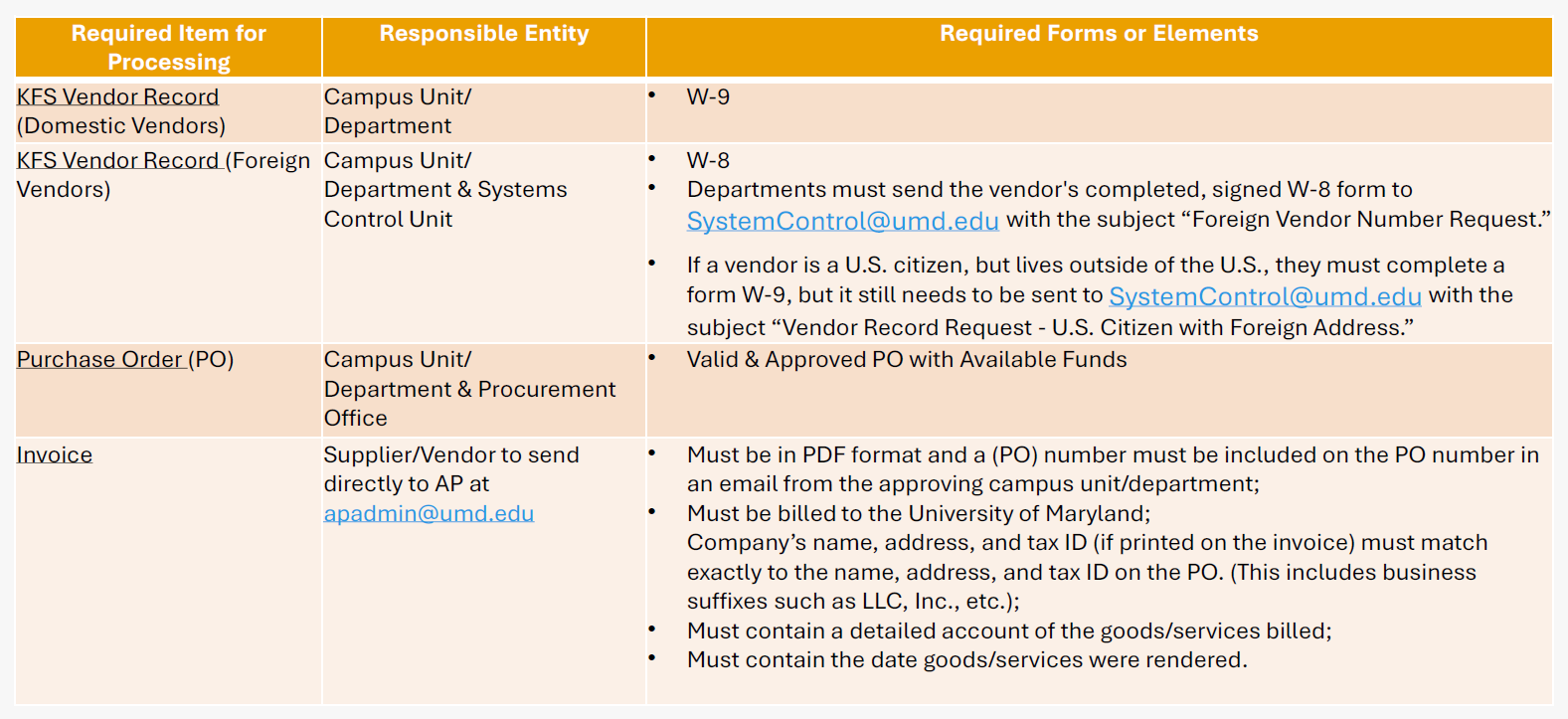

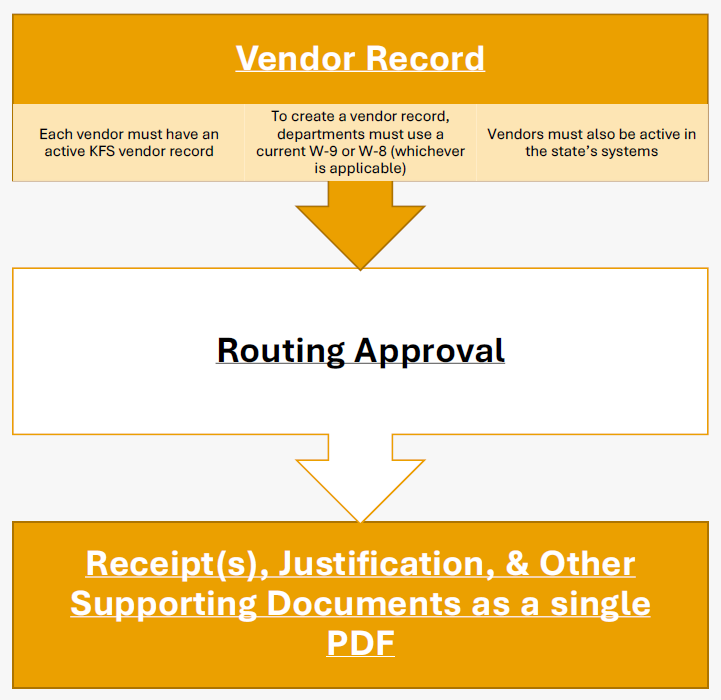

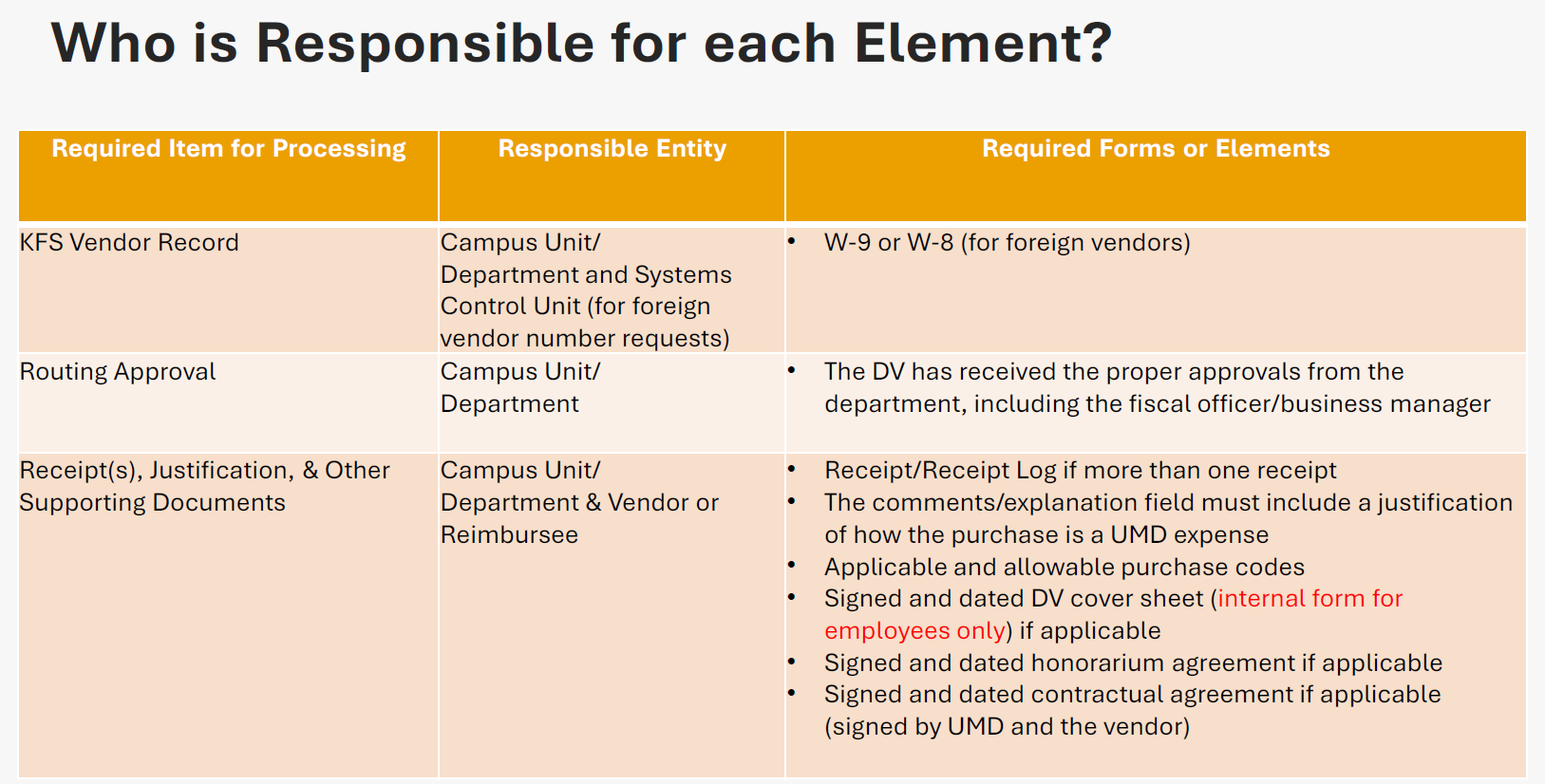

- W-9s are valid for 4 years

- For people who refuse to submit W-9s:

- The state will deduct 24% of their money

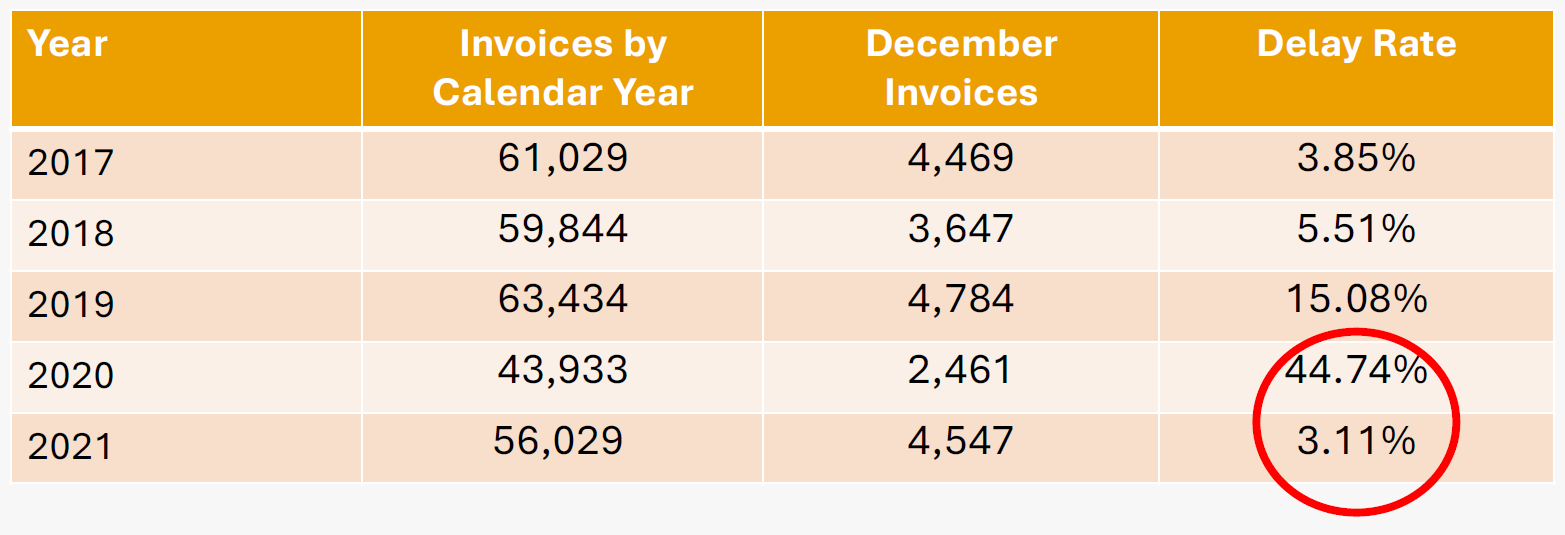

- Between September 2021 and November 2021, payments were remitted by the state 30-37 days from the date on the invoice, on average.

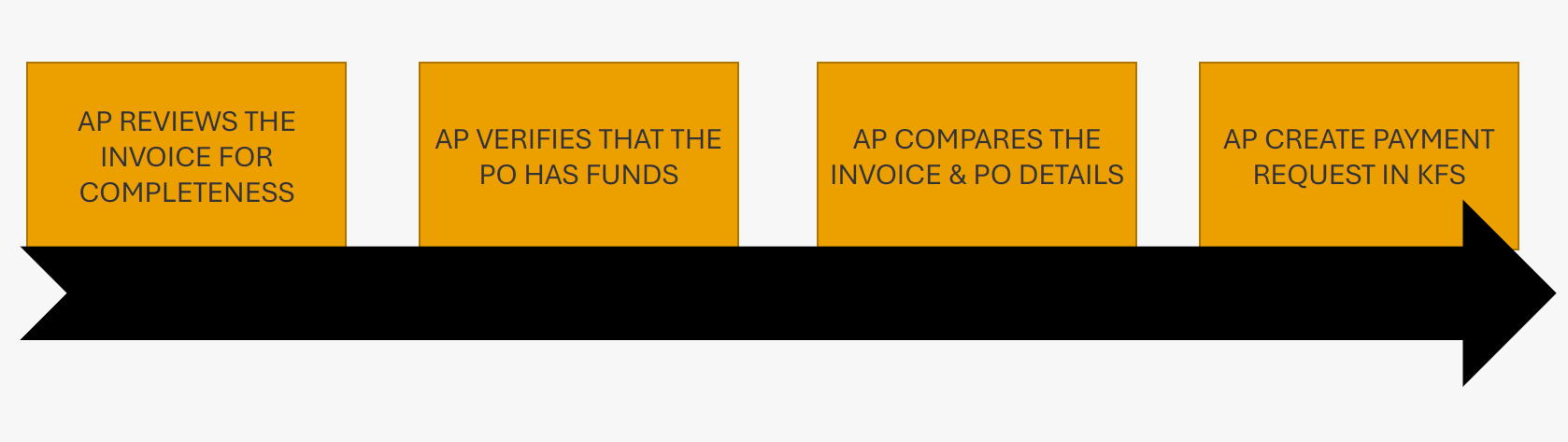

- Most payments cycle through AP within 2-4 days of being received (if received complete and correct), on average.

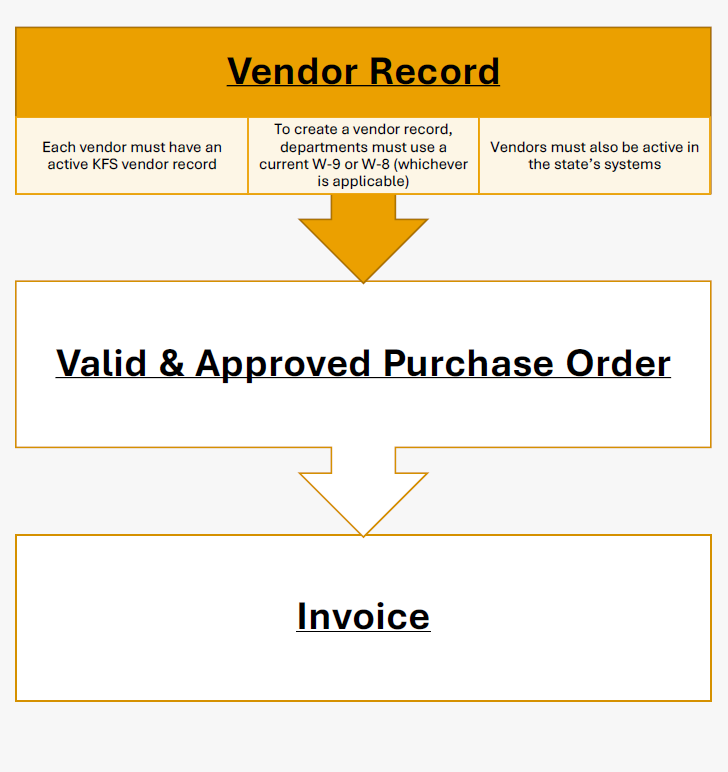

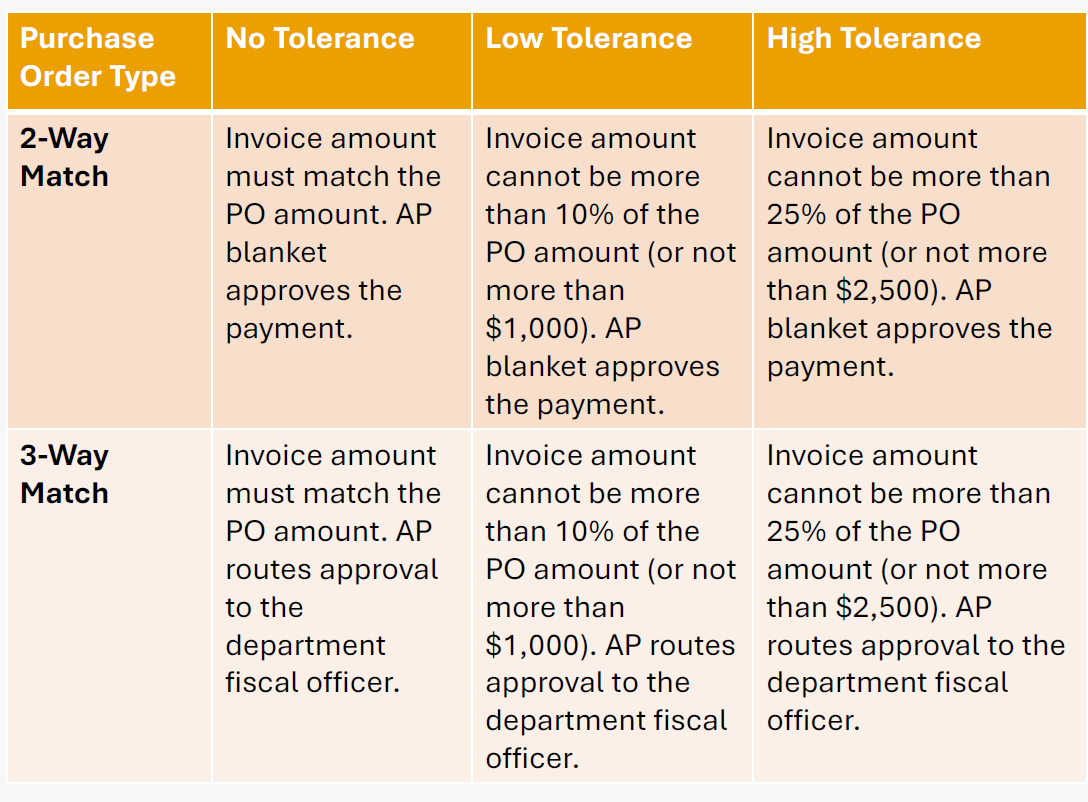

Base on the PO details

- AP will know that it is okay to pay vendors based on the details of the invoices that are submitted and the corresponding purchase orders.

- All invoices should be dated, have a list of goods/services that were provided to the University, and be accompanied by (or contain) an approved purchase order number.

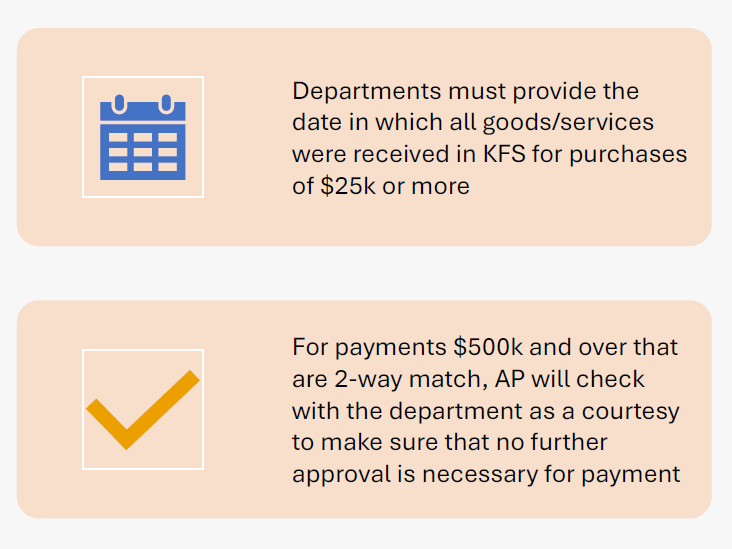

- AP does not submit payment requests tied to 3-way match purchase orders until the campus unit/department's fiscal officer approves the request.

- After AP approves a payment, a pay date is updated in KFS.

- This date is not the actual date the state issued payment.

- Please add 7 days to this date before contacting AP for a status.

- SUPPLIER ACCOUNTS Invoices Lines for Organization (RPT689) is available.

- What is the purpose of this report?

This report should be used to review a list of all Supplier invoices and their statuses for driver worktags to which you have access to run. The report displays the Supplier Invoice Document, Total Supplier Invoice Amount Invoice Date, Invoice Received Date, Invoice Status, Payment Status and Payment related information. - Who should run the report?

Its intended audiences are primarily for campus department users - Important Notes:

Users can navigate to the date parameter to access data for the period for which data is required.

Please note that if the payment was processed in KFS then users must go back to KFS to locate the payment information.

- Invoice Issues

- PO Issues

- Insufficient Funds

- Closed PO

- Improper Quantities or Rates on the PO

- Inactive Vendor

- Waiting

- Invoice Amendments from vendor (ex: if not billed to the University of Maryland)

- Departments holding invoices to submit in Bulk

- PO amendments

- Fiscal Officer Approval (3-match)

- Vendor Re-activation

- Payments to DACA students must go through payroll

- Cara Diggs cdiggs78@umd.edu is the Non-Resident Alien Specialist and can address any questions

- Employees should not use personal credit cards (or any form of payment) to pay a vendor or individual for goods/services on behalf of the department.

- Payments to vendors/individuals should be made by the State of Maryland.

- Departments should issue a PO and the person should bill the University of Maryland.

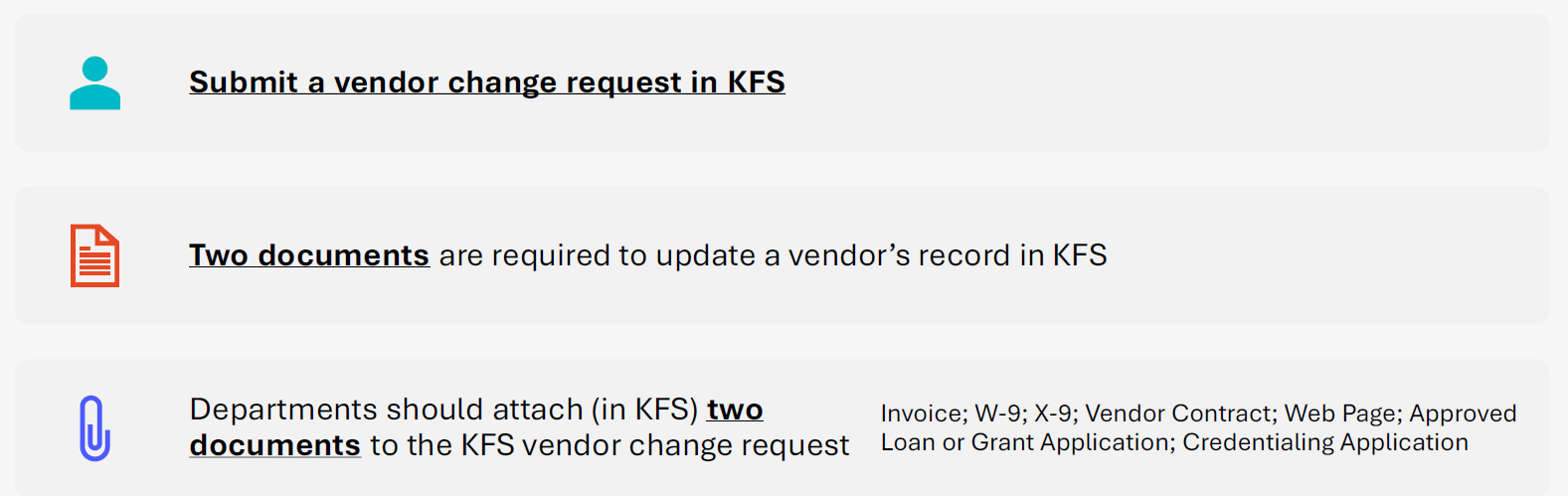

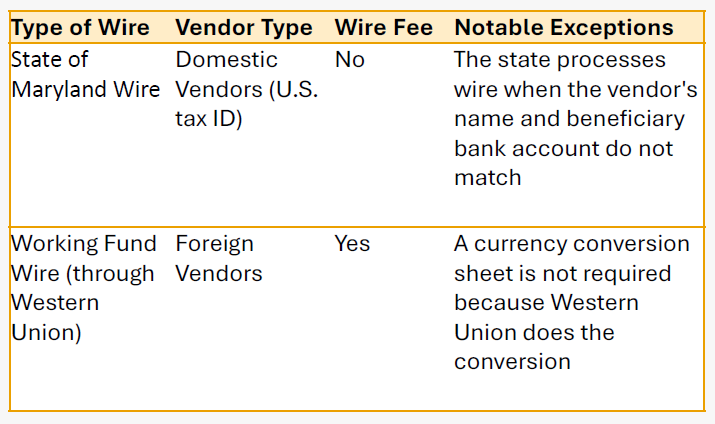

- The X-9 form, vendor's invoice, PO details, and KFS vendor record must all match in order to process a wire.

- Dates and signatures on the forms are required.

- All documents must be in a single PDF.

- A screenshot of the employee's PHR screen should be submitted with the vendor record request.

- It must show that the employee has an active appointment with the university.

- Under no circumstances should an individual who is not an employee of the university be added to the vendor file as an employee.

- Stipends require an agreement, similar to an honorarium agreement.

- A 1099 reportable object should be used.

- If a stipend is paid to an employee, it should be processed via Payroll.

- If a stipend is for a student, it must be processed as an award through financial aid.

- One year

- The State of Maryland will not approve reimbursements for purchases that are more than one year old.

- Object codes and payments reason code must align.

- Example: Relocation Object code 3770 can be used if the payment reason code is for relocation expenses.

- It cannot be used if the Payment Reason code is something else (e.g., Reimbursement for Out-of-Pocket Expense)

- See a full list of payment reason codes here

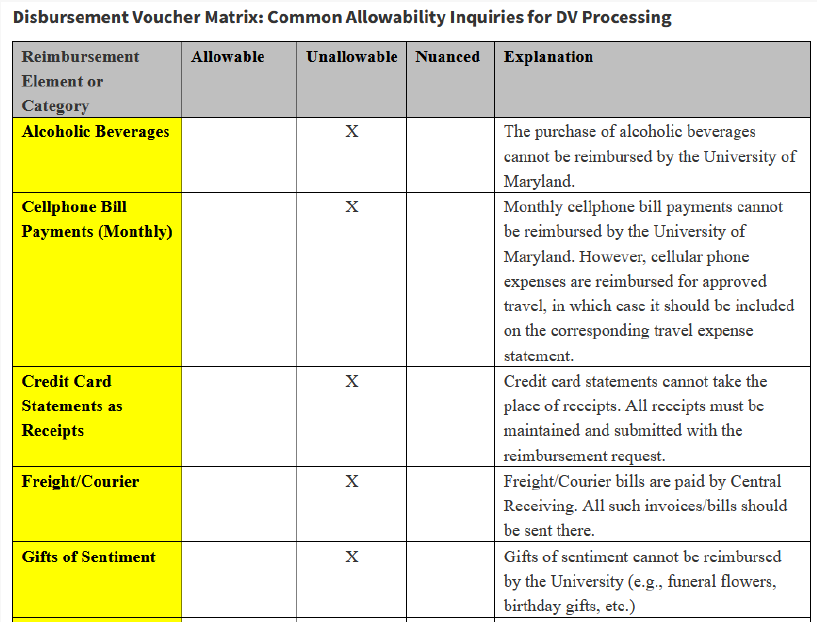

- Documents were not uploaded as a single PDF.

- Receipt(s) and/or other supporting documents are not legible.

- Inactive vendor

- Insufficient justification of expenses,

- Who? What? Where? When? Why? For What purpose?

- Routing the DV to a specific AP staff member.

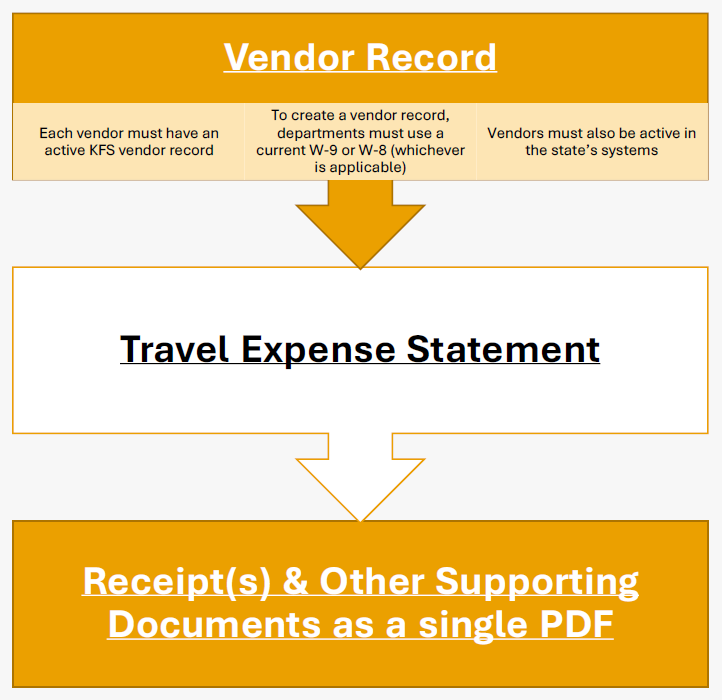

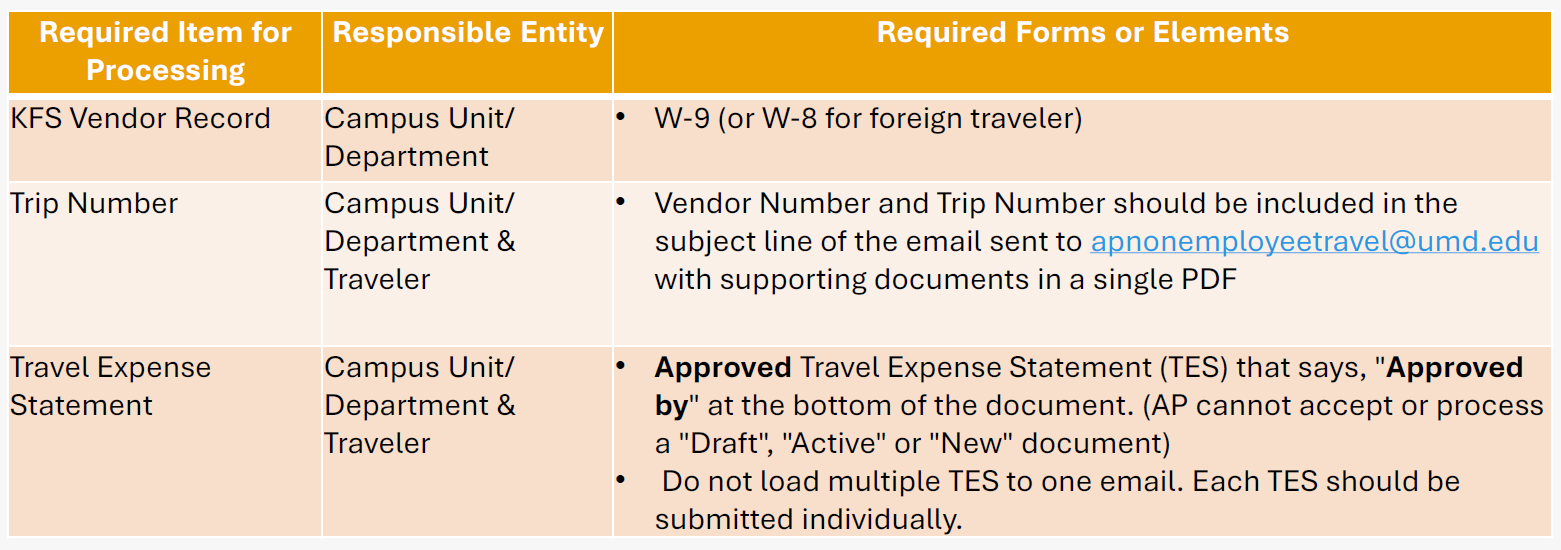

Required information from the Traveler:

- Social Security number

- Mailing address (must match the address in KFS or an updated W-9 should be requested)

Departments should ensure the following are on the TES:

- Department's name is listed

- TES point of contact from the department (name and email address)

- Departure and Return Dates

- Origin and Destination

- Trip Purpose

- Detailed Travel Expenses (with cost codes, KFS account number, object codes, and amounts)

- Cost codes cannot be combined and should be on separate lines

- Supplemental documents should contain a receipt to support each amount listed on the TES

- A credit card statement cannot be submitted in the place of a receipt. It can only be provided as backup and additional proof of payment

- Receipts must be clear, legible (translated in English if applicable), and detail all items purchased

- Receipts that are blurry, smudged, or faded will not be accepted

- Date of the receipts should not be over one year old

- Transportation or parking under $75 does not require a receipt

- Consecutive day parking policy and receipt requirement

- Signed Traveler Attestation (or a negative assurance letter)

- Documents were not uploaded as a single PDF.

- Receipt(s) and/or other supporting documents are not legible.

- Departments submitting the wrong Travel Expense Statement

- Approved TES should be used, not "draft", "active", or "new"

Workday users may utilize RPT689 Supplier Accounts Invoices Lines for Organization to determine supplier invoice status including RSTARS payment information.