Financial Reporting

You can use the "KFS Account to Driver Worktag" report available in the UMD Top Financial Management Reports under the "Other Reports" tab. Alternatively, you can type the KFS Account number in the search field. In Workday, KFS Accounts are now categorized into grant, gift, project, and USource.

After running the report, click the "Edit/View Grid Preferences" icon. Then, click the three dots next to a column to hide, freeze, or reorder it.

When the report is ready, it will usually appear on the right-hand side of the Workday page. If you miss it, use the notification or inbox icons to locate the report. Additionally, check your web browser's download section.

Balance Sheet reports are driven by fund and balancing unit data. Make sure you select the appropriate balancing unit hierarchy or fund hierarchy in the organization prompt.

Make sure there are no spaces between "RPT" and the report number when typing it in. If you still get an error indicating that there are no results, the report may not exist as entered. Another possibility is that your role may not grant you access to that report.

Due to the large amount of data being pulled, the report runs in the background. Click the blue "Notify Me Later" button, and Workday will notify you when the report is ready. You can also click for full screen view to reveal the scroll bars.

If you and your supervisor need to adjust your security role, complete the "Add or Remove a Worker’s Workday Security Role Form." The form can be found at Workday Request Forms - UMD Service Center

Accounts Payable

Yes, all invoices should be submitted to APadmin@umd.edu promptly after services/goods are rendered to avoid delays in processing.

However, if you are working with University of Maryland Facilities Management, Dining Services, or University Libraries you should submit your invoices to them directly. These divisions have delegated accounts payable units.

Vendors/Suppliers

- After the Accounts Payable (AP) team approves payment of your invoice and submits it to the State of Maryland Comptroller to issue payment, you may check the payment status here.

- Vendors with a U.S. bank account are encouraged to enroll in the State of Maryland’s ACH program to receive payment. To enroll, you must submit the Form GADX-10 as directed. The form can be accessed here.

UMD Campus Units/Departments

- After the Accounts Payable (AP) team approves a payment, a Pay Date is updated in KFS. This date is not the actual date the state issued payment. Please add 7 days to this date before contacting AP for a status.

In KFS, click the View Payment History tab on the PO. If there is at least one payment, but not the payment in question, you can open the PREQ, then click Invoice Image and Invoice Image on Optix System by Purchase Order to see all invoices scanned, whether paid or unpaid.

Vendors with a U.S. bank account are encouraged to enroll in the State of Maryland’s ACH program to receive payment. To enroll, you must submit the Form GADX-10 as directed. The form can be accessed here.

Workday users may utilize RPT689 Supplier Accounts Invoices Lines for Organization to determine supplier invoice status including RSTARS payment information.

Departments should create an agreement (on department letterhead) that is tailored for the given engagement and signed by both the honorarium recipient and department representative. (See Sample Honorarium Agreement)

The payment should be submitted as a disbursement voucher and follow the normal DV procedures.

Please submit inquiries to APInquiries@umd.edu. In the subject line of the email, include the PO Number and Invoice Number.

Invoices should be billed to the University of Maryland. Please note, invoices should not include the Accounts Payable staff or office as the requester of goods/services. You may, however, indicate on the invoice the campus department/unit contact person for whom goods/services were provided.

Once payments are approved by the University and disbursed by the state, the University’s obligation is fulfilled, and all goods/services should be rendered to the University by the vendor/supplier. Any disputes or questions related to liability offsets (state or federal) should be taken up with the state of Maryland using the contact information below:

- State Information, tax debt withholding or state liability offset notices

Phone: 410-767-1642 - Federal Information, Form 1099 returns, Federal Offset of Payments

Phone: 410-260-7350

Payroll

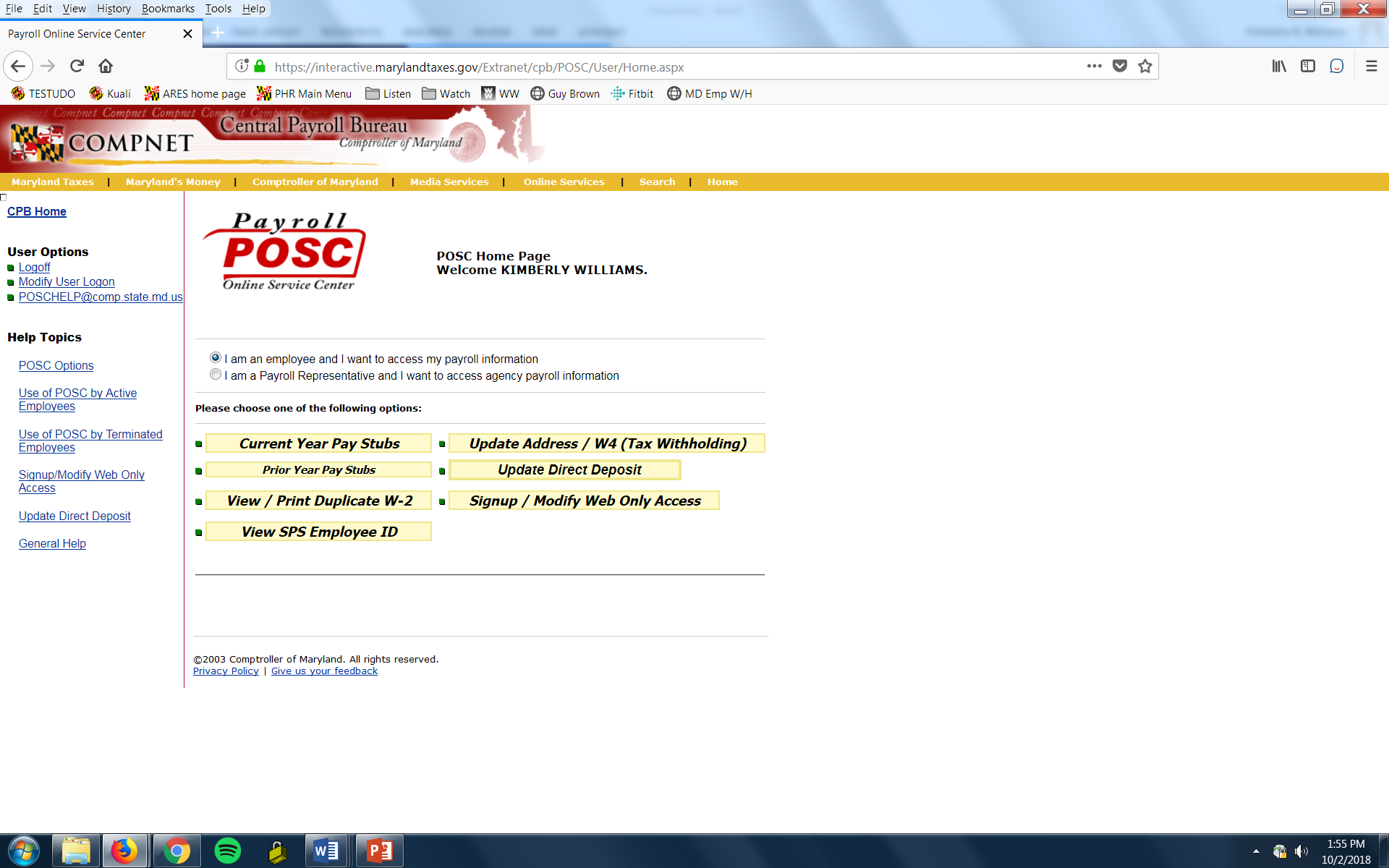

The Payroll Online Service Center (POSC) is the State of Maryland’s system where all active state employees and recently terminated/retired employees who are / were paid by the Central Payroll Bureau (CPB) can view/print 12 rolling months of pay stub information, the most 3 recent years of duplicate W2s, and update addresses and W4 exemptions.

Read more information about POSC here.

- Pay adjustments for current and active salaried appointments that require a corresponding pay adjustment should be calculated using a 14-day bi-weekly pay factor.

- Pay Adjustment should be calculated using a 10-day bi-weekly factor for all initial, new, or terminating appointments as well as for all salary additions.

Read more about pay adjustments here.

1. To sign up for POSC, employees need their Agency Code and the last check/direct deposit advice number, which can be obtained from Payroll Services. Visit the POSC website for more information.

- Full Name

- UID

- Last four digits of the SSN

- Department

- A brief note authorizing Payroll Services to provide the employee's last check/direct deposit advice number to access POSC.

- Employees: Take the social security card to your department’s payroll processor and request the correction.

- Payroll Processors:

- Access the employee record in PHR and go to the "Employee Information" screen

- Click the link next to the employee's current SSN that says "Change SSN"

- Add the new SSN, select a reason for the change, and add notes if applicable

- Click "Save"

- Verify the new SSN is correct and click "Submit to Payroll Services"

The process to change the SSN in all applicable campus systems may take 10-14 days.

Once an SSN change request is submitted, no additional SSN changes can be submitted for that

employee until the original request is processed.

Read more information here.

- Complete a new paper W4. For terminated employees changing their address for tax form purposes, the entire form needs to be completed and “Address Change Only” should be written at the top.

- On Payroll Online Service Center (POSC), click on Update Address/W4 (Tax Withholding) (see below).

Complete the Pay Advance & Recovery form found here and fax to Payroll Services at Ext 58685.

NOTE: Day 10 (Day 9 on short pay period) is last day a pay advance may be requested to ensure it is recovered from next pay check. Same day checks can be cut on Days 9 and 10 as long as the request is received by Payroll services no later than 1 p.m.

Read more information about the process of requesting a pay advance here.

1. The State employee's salary is budgeted as an annual amount within a fiscal year. The annual salary is for 365 days and paid on a bi-weekly basis. The bi-weekly pay consists of 14 days. To arrive at a correct bi-weekly salary rate, the annual salary is divided by the fraction 26.071428 in a non-leap year.

Payroll Calculation Example:

Annual Salary ($36,000) / Adjusted Pay Periods (26.071428) = Bi-weekly Pay ($1,380.82)

2. In case of a leap year, there is an additional day (366 days in a year) so the pay period factor to be used is 26.142857 resulting in a further reduced biweekly rate.

- A pay advance is only available when an employee will not be paid all of the wages they are due on a specific pay day. This could be due to their appointment being entered after the deadline, a glitch in the payroll system causing the appointment not to pay (Payroll Services usually will notify department's payroll representative in this case), etc.

- Pay advances can only be 60% of the gross amount due to the employee. The checks will not be cut until pay day.

Read more information about pay advance here.

W2s are mailed from the State of Maryland by January 31st. You can also access them online from the State of Maryland’s Online Payroll (POSC) website. The University Agency Code (UMCP – 360222) and your last pay check/advice number will be necessary to create an account if you do not have an account. Otherwise, “Log On” with your credentials. If you do not receive it in the mail and are unable to access your W2 on POSC, you can call Maryland’s Central Payroll Bureau directly to request a duplicate tax form. The phone number is 410-260-7964.

- All active regular exempt and non exempt employees are eligible.

- Generally hourly employees are not eligible due to minimum wage laws. For case-by-case analysis, contact Payroll Services.

- Pay advances are not done for the following situations:

- When the employee did not sign their time sheet

- When the supervisor does not approve a time sheet by the deadline

- When it is the last pay for the employee

- When it is for overtime only

- Non standard one-time payments

Read more information about pay advance eligibility here.

Financial Services

Click here to download the capital asset object expense codes.

Capital Asset Management

Please contact Inventory Control (inventorycontrol@umd.edu)

Please contact Inventory Control (inventorycontrol@umd.edu)

DNCA assets should not have a red tag unless it was placed before the blue tags were ordered. Red tags are for capital assets only. Contact Controller@umd.edu if you remove any tags.

Contact Controller@umd.edu if you remove those tags