In order to sign up for direct deposit, a Direct Deposit Authorization form can either be sent to Payroll Services or to the Central Payroll Bureau at P.O. Box 2396, Annapolis, MD 21404. The form must be typed with the exception of the signature. The signature must be handwritten. Only original forms will be accepted. Please click the link below to download the Director Deposit Authorization form.

Once you submit the Direct Deposit authorization form, it may take up to 3-4 pay periods for your direct deposit information to take effect. Once an employee is in the payroll system, it will take 2 more pay periods for direct deposit to begin. A “pre-note” is done which is a test of the bank routing and account number. If the bank does not reject the pre-note, the direct deposit will begin next pay period.

No. Direct Deposits may not be split. However, a Payroll Deduction may be set up with the State Employee's Credit Union (SECU) which will transfer a predetermined amount from your designation direct deposit account into a SECU account of your choice. For more information, please contact your local SECU branch.

If you close your account without notifying Central Payroll, Central Payroll will still attempt to deposit your funds into the account. If the account is closed, the direct deposit will "Fail" and it can take up to 3 Business Days before the funds are returned to the State of Maryland. Once this occurs, Central Payroll will issue a paper check and mail it directly to the employee’s Official Payroll Address.

A direct deposit will stop within 21 days of filing the form with the Central Payroll Bureau. You will begin receiving a regular paycheck when direct deposit has stopped. Do NOT close your bank account until you have received your first regular paycheck. If you close your account and a direct deposit is attempted, it will delay the receipt of your wages.

For U.S. citizens who are not claiming “Exempt” from either Federal or State withholding, the easiest way to update your W4 and/or State Withholding form will be to visit POSC and submit new forms. All non U.S. Citizens must complete paper forms and send them to Cara Diggs in Payroll Services 1101 L Chesapeake Bldg. College Park, MD 20742. Employees who are requesting to be "Exempt" from Federal or State taxes, must submit an original form to either Payroll Services or Central Payroll. W4/MW507 forms may be found on the Payroll Forms page.

Yes. Visit Central Payroll's "Net Pay Calculator". You will need a copy of your most recent paystub. With the information from your most recent paystub, you are able to input the figures into the calculator and change information such as tax status or number of exemptions to see how it will affect your pay. Here is the link for Net Pay Calculator.

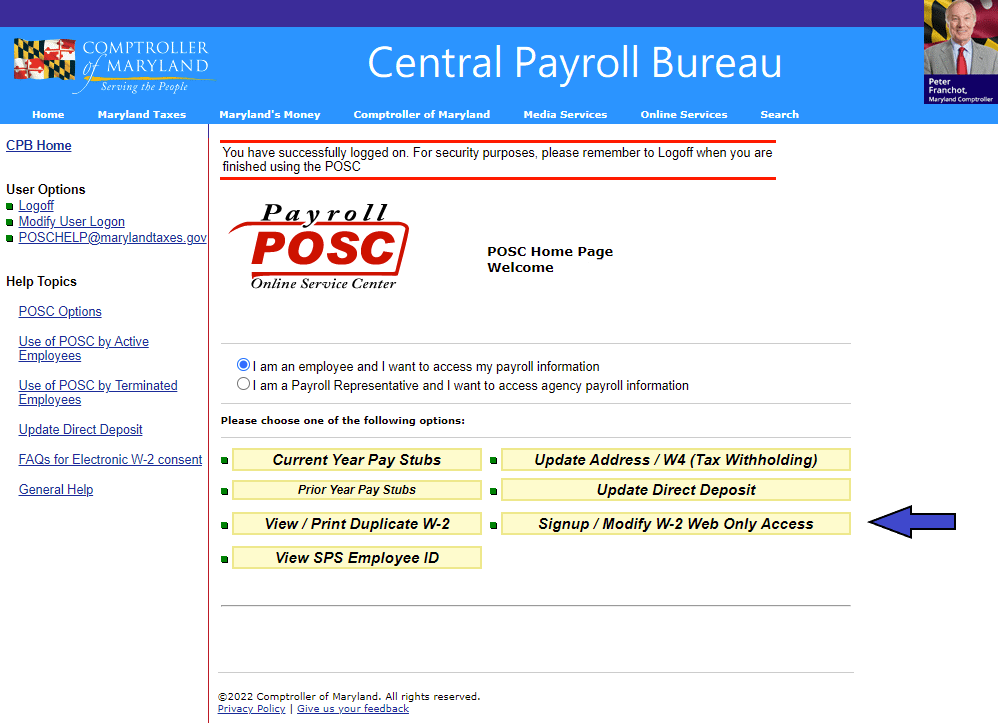

You can sign up to receive W2 electronic format by authorizing W2 consent on the POSC home page under Signup / Modify W-2 Web Only Access.

W2s are mailed from the State of Maryland by January 31st. You can also access them online from the State of Maryland’s Online Payroll (POSC) website. The University Agency Code (UMCP – 360222) and your last pay check/advice number will be necessary to create an account if you do not have an account. Otherwise, “Log On” with your credentials. If you do not receive it in the mail and are unable to access your W2 on POSC, you can call Maryland’s Central Payroll Bureau directly to request a duplicate tax form. The phone number is 410-260-7964.

Employees can do the following on Central Payroll's website:

- Change Taxes/Exemptions

- Print W2s

- Update Direct Deposit

- Sign Up to Suppress Payroll Check Printing

- Print Paychecks current - back two years

For information on viewing your paycheck stubs please click POSC Instructions PDF